- This Week in PR Takes

- Posts

- This Week in PR Takes - Week 18

This Week in PR Takes - Week 18

Week 18

Happy Friday!

It was a short work week, so it’s a short take week too. Good luck to everyone trying to cram five days of work into four work days.

-Brian

Take of the Week:

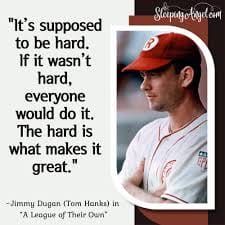

There were a lot of great takes over the past week (see below), but this one from Riddhi stood out to me. Speaking for myself, I still love media relations. As I tell others, it’s far and away the most fun in PR/Comms. Is it a grind? Absolutely. Is it easy? Nope. But, if it were easy then everyone would do it.

I agree with the sentiment that the templated, spray and pray version is long gone, and I would argue - did it really ever work? Maybe people don’t like it because they found success in this now archaic model, and have to learn how to take the time, research and craft meaningful, tailored pitches.

The Rest of the Takes:

- I think we have all had at least one day (and probably more) where we have felt the vibe that Carly wrote about in her “brutal reality” about PR post

- Becca on the PR hills that she’ll die on, and no surprise there’s a bullet in there about the good ol’ Oxford comma

- What should a day in the life of a media relations person look like? Brandon wrote a take on that and put a flag in the ground even if others think it’s lazy

- Sarah with a few thoughts on why pitches didn’t work

That’s it for this week’s takes, thank you for taking the time to read.

-Brian

https://www.linkedin.com/in/bkramer/

He’s already IPO’d once – this time’s different

Spencer Rascoff grew Zillow from seed to IPO. But everyday investors couldn’t join until then, missing early gains. So he did things differently with Pacaso. They’ve made $110M+ in gross profits disrupting a $1.3T market. And after reserving the Nasdaq ticker PCSO, you can join for $2.80/share until 5/29.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.